AI Investments: Navigating Sustainable Growth in a Dynamic Landscape

The Surge in AI Investments: A Year of Milestones

Key Metrics from 2024 and 2025

The past couple of years have seen a tremendous surge in AI investments, marking 2024 and 2025 as pivotal years in the AI landscape. According to TechCrunch, 49 AI startups in the U.S. alone secured funding rounds of $100 million or more in 2024. In an impressive stride, 2025 has already matched those numbers, with multiple companies like Anysphere, which raised $2.3 billion, setting unparalleled precedents. The rise of unicorn startups such as Parallel, Hippocratic AI, and Fireworks AI exemplifies the industry’s relentless upward trajectory.

This rapid accumulation of capital has not only fostered a competitive market but also precipitated a maturation in AI technology’s capabilities, driving further innovations across sectors.

Comparison of Investment Trends Year-on-Year

Analyzing the investment trends from 2024 to 2025 reveals a robust pattern of sustainable growth in AI strategies. The consistency in the number of huge funding rounds signifies investor confidence and an anticipation of profitable returns in the AI domain. This period has illustrated a near doubling in sequel investments, emphasizing how initial bets are paying off significantly as these technologies mature and prove their market viability.

As we project towards the future, maintaining this growth trajectory will necessitate a nuanced understanding of investment trends and a strategic push towards diversification and sustainable practices.

Implications on Market Stability

The burgeoning investments have significant implications for market stability. While sheer funding volume suggests a healthy market, it also invites scrutiny over potential overvaluation and bubble risks within the tech sphere. The tendency towards high-value rounds stresses the importance of balanced investment portfolios that prioritize long-term resilience over immediate returns. Consequently, stakeholders must tread carefully, ensuring that sustainable growth aligns with realistic performance metrics to prevent market volatility.

Crafting AI Strategies for Sustainable Growth

Diversifying Investment Portfolios

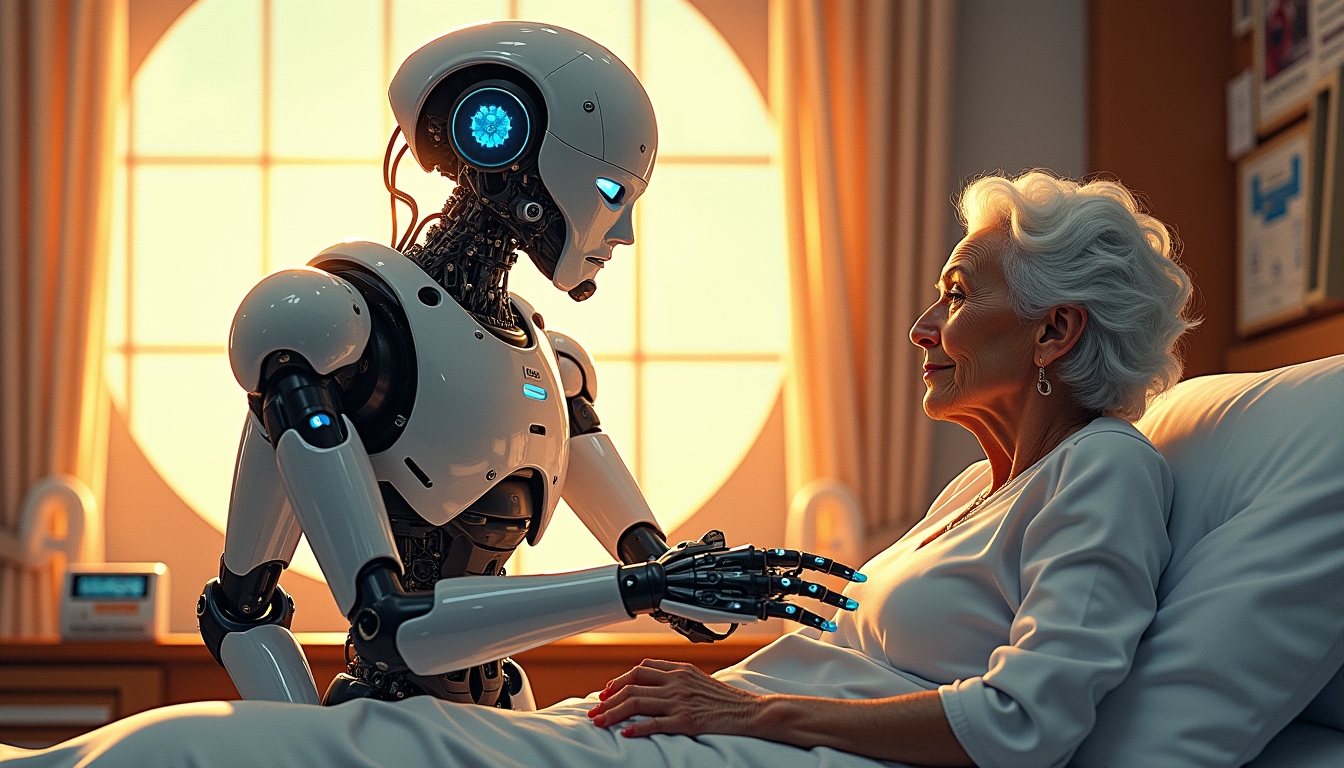

In an era defined by technological acceleration, diversifying AI investment portfolios becomes imperative. Ensuring a spread across diverse AI sectors—from healthcare to autonomous systems—can mitigate risks and cushion against unexpected market downturns. This diversification not only stabilizes returns but also fuels innovation by sponsoring a myriad of use-case-specific technologies.

Fostering Innovation through Collaboration

Collaborative efforts, such as partnerships between data-centric firms and AI innovators, have proven crucial in propelling AI advancements. Establishing alliances enables stakeholders to pool resources, share risks, and accelerate the development of cutting-edge solutions. Collaboration also brings together varied expertise, fostering a rich environment for creative solutions that feed sustainable growth.

Looking ahead, partnerships will remain a linchpin in the quest for future resilience, ensuring that AI advancements continue to thrive against a backdrop of economic and regulatory evolutions.

Risk Assessment and Management

In AI investments, understanding potential pitfalls is as critical as recognizing opportunities. Intelligent risk assessment frameworks that factor in both technological and market dynamics are essential. As AI strategies evolve, it is crucial to manage risks related to data privacy, regulatory compliance, and ethical use of AI tools. By implementing solid risk management processes, investors can safeguard against systemic failures and foster an environment ripe for consistent growth.

The Role of Future Resilience in AI Investments

Understanding Future Resilience

Future resilience in AI investments relates to the capacity of companies to adapt and thrive amid economic uncertainties, regulatory changes, and technological disruptions. It involves strategic foresight in planning, ensuring robustness against unforeseen challenges while seizing emerging opportunities.

Strategic Planning for Economic Uncertainty

To navigate economic uncertainties, AI investments must be backed by strategic planning that incorporates contingencies for varying economic scenarios. This involves agile methodologies, adaptive business models, and a strong emphasis on sustainable innovation—ensuring that AI strategies are not only resilient but also proactive in addressing change.

Adapting to Changing Regulations

The evolving regulatory landscape demands that AI companies remain vigilant and proactive. Adapting to new regulations quickly can differentiate successful firms from those that falter. Organizations should focus on compliance frameworks that safeguard their operations and maintain market trust while embracing the evolving legal and ethical AI terrain.

The Impact of AI on Economic Growth and Job Markets

Disruption vs. Opportunity

AI’s role in economic growth is a double-edged sword poised between disruption and opportunity. While automation and intelligent systems are reshaping job markets, creating some disruptions, they also open immense avenues for new job creation in AI and related industries. Re-skilling and up-skilling programs are vital in this transitional phase to mitigate job displacement side effects.

Economic Inequality and AI

Despite AI’s potential for growth, it can exacerbate economic inequalities. The disparity between those who can access AI technologies and those who cannot, often results in unequal benefits distribution. Policymakers and stakeholders must ensure equitable access and distribution to harness AI’s full potential, fostering inclusive economic advancements.

Case Studies of AI’s Economic Impact

Illustrative case studies, such as those discussed in the MIT Technology Review, provide valuable insights into AI’s complex economic roles. Insights from experts like Mat Honan and David Rotman highlight both the transformative impacts and the challenges AI presents to today’s economies.

Forecasting the Future of AI Investments

Trend Analysis and Predictive Insights

The next five years in AI investments will see a marked evolution in both funding strategies and technology adoption. A keen eye on trend analysis and predictive insights can equip investors with the foresight needed for making informed decisions. Identifying upcoming technologies and gauging market sentiments will be pivotal in navigating the AI investment landscape.

Shifts in Investor Mindset

Investor mindsets are gradually shifting towards more sustainable and ethically conscious investment strategies. As AI technology advances, investors are aligning their objectives with global sustainability goals, recognizing the long-term benefits of responsible investments over short-term gains.

Upcoming Technologies to Watch

Technologies such as quantum computing, edge AI, and sustainable AI solutions are poised for accelerated growth post-2026. Monitoring these technologies as they evolve will be key for stakeholders aiming to position themselves competitively in the future resilience of AI investments.

Embrace the AI wave with astute strategies and resilient planning to harness its full potential.